Get All the Latest News

Delivered to Your Inbox

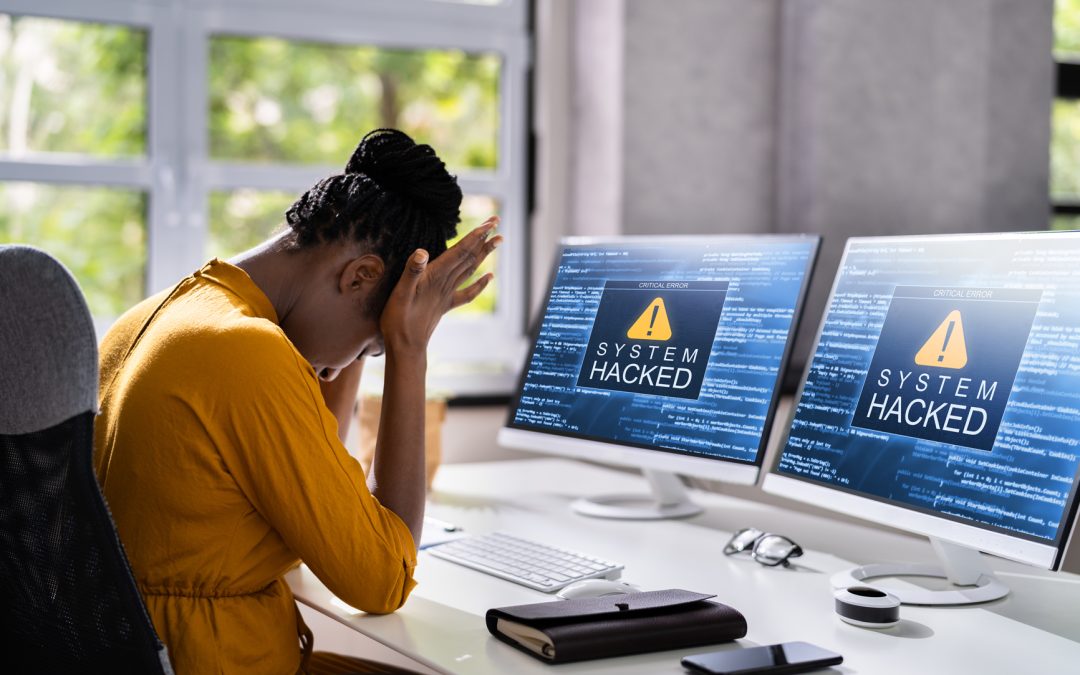

Are Vendors Your Vulnerability?

An estimated 98% of organizations worldwide have relationships with at least one third-party vendor that’s been breached.1 The NCUA recently reported an increase in cybersecurity attacks on credit union vendors and suppliers. This particular threat is at every credit...

Executive Playbook: Enhance the Likelihood of a Successful ERP or CRM Implementation for Your Business

Perhaps you’ve been through a Digital Transformation project before (examples: ERP upgrade, CRM implementation, etc.). If so, you recognize their potential benefits. You also know just how hard they are. And, if you've not been through one, recognize that these...

Navigating Tax Landscape: Strategies for Businesses and Individuals

Important Federal Tax Tasks for Individual Taxpayers by April 15, 2024 File an income tax return (Form 1040) for 2023 and pay any tax due. You can request an automatic 6-month extension to file, but this does not extend your deadline to pay any tax due. Make the first...

The Case for Creating a Credit Union Foundation

Credit unions first appeared in the United States back in the 19th century and they have always been champions of community-focused banking. At the core of every credit unions’ mission is a fundamental commitment to serve their members as well as the regions, cities,...

SingerLewak LLP – Riding a wave into the Aloha State, SingerLewak combines with Lemke, Chinen & Tanaka

SingerLewak LLP, a top 100 accounting and consulting firm based in the U.S. since 1959 has announced its intention to combine with Lemke, Chinen & Tanaka. Since 1943 Lemke, Chinen & Tanaka have provided audit, back-office accounting, tax preparation, and...

Maximizing Your Legacy: The Crucial Role of Estate Planning

Estate planning is a crucial aspect of financial management that goes beyond just distributing your wealth. It involves a strategic approach to maximizing your legacy, mitigating taxes, and fostering harmony among loved ones. In this article, we delve into the key...

Expanding our horizons in the Golden State: SingerLewak welcomes Jerome Bellotti & Associates

SingerLewak, a leading West Coast based accounting and consulting firm, is pleased to announce its combination with Jerome Bellotti & Associates, a full-service accounting and tax firm based in Los Gatos, California. For over 25 years Jerome Bellotti &...

Financial Accounting Foundation Names David Finkelstein to the Private Company Council

The Board of Trustees of the Financial Accounting Foundation (FAF) has appointed David Finkelstein to the Private Company Council (PCC), effective January 1, 2024. Mr. Finkelstein replaces former PCC member Jeremy Dillard, who was appointed as a PCC member in January...

IT Spend 2024: things are very different now – what should we budget for?

With 2024 around the corner, many entities are working through their IT budgeting process. Clearly, things are very different than they were a year ago; your ’24 IT budget is likely impacted by these elements, at a minimum: Interest rates have limited business’...

SingerLewak Announces Additional Growth in the Orange County California Market

SingerLewak, a Top 100 firm, is combining operations with HBLA. SingerLewak, a Top 100 firm headquartered in Los Angeles, California, with additional locations in Northern California, Colorado, Georgia, Nevada, Oregon, and Texas, is combining operations with HBLA....

Never miss an update

Sign up for our newsletter and check the boxes below to receive our tax alerts, podcasts, webinars, announcements, and event invitations.